How Does the LexisNexis Freeze Work?

Since there’s so much confusion about the LexisNexis freeze service and how it works, we created a guide to the security freeze process to answer your questions.

With the sharp rise in identity theft and financial fraud, protecting yourself against online criminal acts is more important than ever.

With LexisNexis Risk Solutions, you have new protection options for spam fraud and abuse, as well as financial services created without your permission.

The first step toward securing your privacy is to request a security freeze with the LexisNexis service.

In our guide, we will share details about LexisNexis, its security freeze service, and how you can better protect your digital privacy.

If you’re interested in additional ways to protect yourself on the internet, get in touch with us today at 941-259-4554 for a free consultation about online reputation management.

Let’s get started!

LexisNexis: Data Solutions for Professionals

Created in 1956 as a tool for computer-assisted legal research (CALR), LexisNexis has evolved into a data analytics powerhouse.

LexisNexis services are divided across two major websites:

- Legal and Professional Solutions: For law firms, legal professionals, and government agencies seeking news, legal documents and business insights

- Risk Solutions: For companies, government agencies, and individuals seeking information related to compliance issues, identity solutions, risk decision-making, and fraud detection.

Access to the LexisNexis service is by paid subscription. The service is widely used by government entities as well as legal firms and law professionals.

What is LexisNexis Freeze?

Created to help consumers protect against financial fraud and identity theft, the LexisNexis Risk Solutions Consumer Center launched Freeze, a service that prevents both LexisNexis Risk Solutions and SageStream from releasing your LexisNexis Consumer Disclosure Report without your express authorization.

According to the company, the security freeze “is designed to prevent credit, loans, and services from being approved in your name without your consent.”

As a consumer, you have specific rights, according to state and federal laws, to request a security freeze on certain LexisNexis Risk Solutions reports, including your SageStream Consumer Report and the LexisNexis Consumer Disclosure Report. The only way for those reports to be released is if the consumer requests a lift of the security freeze.

The LexisNexis Consumer Disclosure Report

The LexisNexis Consumer Disclosure Report is compiled from public records sources and financial records collected by the LexisNexis Risk Solutions database. Without a security freeze in place, consumer reporting agencies may use a consumer report like this to verify eligibility for loans or other financial services.

The LexisNexis Consumer report may include details like:

- Real estate transaction data

- Property ownership data

- Bankruptcy records

- Liens and tax judgments

- Professional license information

- Historical addresses

Consumers may request a copy of the report via an online request form, by telephone, or by mail.

To discuss other ways to protect your private data online and repair your internet reputation, call us at 941-259-4554 today.

LexisNexis and the Fair Credit Reporting Act (FCRA)

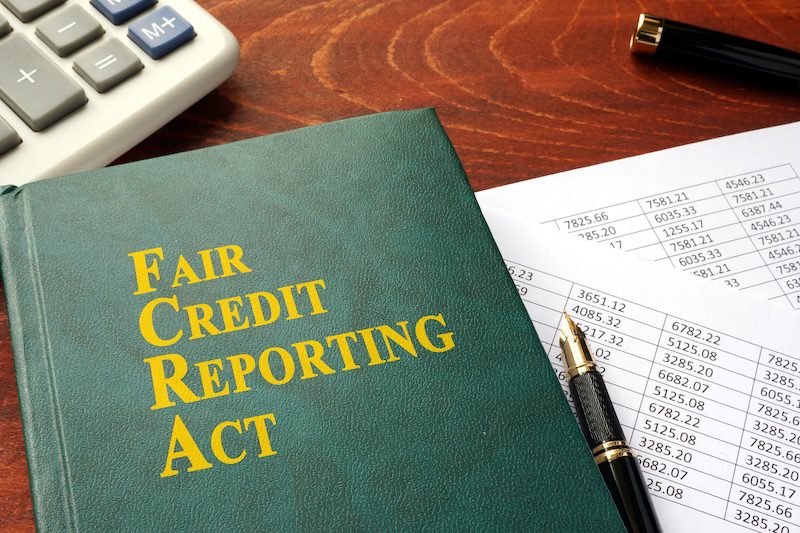

Like all credit reporting agencies, LexisNexis must adhere to the Fair Credit Reporting Act (FCRA). While specific legal protections vary by state, on the federal level, consumers have the right to:

- Be told if your consumer report file has been used against you

- Know what is contained in the consumer report

- Ask for a credit score with your credit report

- Dispute incomplete or inaccurate information

- Give consent for your credit report to be provided to prospective and current employers

With the LexisNexis Risk Solutions security freeze service on your report or credit file, you can protect against spam fraud. It is important to note that security freezes requested from LexisNexis do not freeze your credit file on other major credit reporting agencies like Experian and TransUnion; a security freeze must be requested from each agency.

How Does LexisNexis Use Cookies and Data?

Cookies are small pieces of text or code sent to a web browser by websites you visit. Cookies unlock user preferences, help identify you on future visits to websites, and make websites easier to use.

YouTube is a perfect example of a website that will use cookies and data to tailor visitor experiences. Based on activities like the videos you watch, cookies are used to enhance the quality of your visits by showing you more videos you’ll like.

Companies use cookies to gauge the effectiveness of ads based on a general location or other factors. Ads are influenced by signals like location, user preferences, age, and more. These signals result in ads tailored to you.

LexisNexis uses cookies for certain services and functionalities:

Personalized Content and Ads

Based on past visits, targeting cookies may be used by LexisNexis or its advertising partners in order to improve how services are delivered. Cookies for these additional website partners are stored on your home computer and evaluated on each visit.

Functions on the LexisNexis Website

Personalized content and ads are only a part of the cookie experience on LexisNexis. These cookies also help your browser remember your preferences and user settings. If you block functional cookies, the LexisNexis website may not work correctly.

Performance and Analytics

Just like every company that uses cookies, LexisNexis cookies are used to count the number of visits, track outages, protect against site downtime, and measure audience engagement and site performance. They may also measure the effectiveness of specific pages or tools on the LexisNexis site. Visitor engagement and site statistics are valuable tools that LexisNexis uses to improve overall performance.

In a later section, we will provide tips for blocking cookies or alerting you about them before they are stored on your computer. These tips further enhance your digital privacy.

Can I Remove My Information From LexisNexis?

Data brokers like LexisNexis collect and store billions of records. While such services are useful, they also present potential privacy risks.

Can you opt out of LexisNexis? In other words, can you make a request to have your records removed from the database?

The answer is “yes,” but with certain limitations. On the LexisNexis opt-out request page, you can submit a request and have your records removed. LexisNexis Risk Solutions states the following:

“Please understand that by opting out, you may experience future difficulty using online systems for such things as instant identity and insurance verification. Please note also [sic] that your information will remain in the following products and services: restricted public records products which are available to law enforcement entities; products regulated by the Fair Credit Reporting Act; third-party data available through real-time gateways; news; and legal documents.”

Public records like bankruptcy records, historical addresses, and licensing information will remain on file with the government agencies that collected the data. A law enforcement officer may still have access to your police report or other details. These records will also remain available on other data brokers until you make an opt-out request or information suppression request with each company.

8 Tips for Protecting Against Spam Fraud and Identity Theft

Security freezes are a great way to begin the process of protecting your personally identifying information from theft or loss. Here are some more tips to reduce the threat of identity theft and similar cybercrimes:

- Don’t provide your credit card information or bank account to just anyone. Instead, verify that the request is legitimate before sharing these details online.

- Check that the messages you receive originated from a legitimate government agency or banking organization before responding.

- Do not reply to or click links in any email message that you suspect to be a spam email.

- Protect your computer by using security software, including antivirus and anti-spam tools.

- Don’t post personal information on social media, blogs, or personal websites.

- Request consumer reports from every consumer reporting agency on an annual basis. The three primary agencies are Experian, TransUnion, and Equifax. You should also request your consumer report from LexisNexis.

- Once you receive your credit reports, review them carefully to make sure that there is no fraudulent activity.

- Check your browser privacy settings and select “block third-party cookies” to prevent websites from tracking your visits.

If you’re still concerned about credit fraud or identity theft, request a security freeze from the credit agencies and LexisNexis. By taking these steps, you are on the road to a secure and private future for yourself and your family.

Contact InternetReputation Today

Personal information, including your credit report, legal documents, and other personally identifying details, is readily available on the web.

And because the web is so unpredictable, managing your reputation can be an effective way to keep that info under wraps and out of sight.

Unfortunately, opting out of data collection sites like LexisNexis can be a time-consuming and frustrating process. We can help.

Our customized ORM campaigns utilize the latest in SEO and digital technology to give you control over your online presence. We work tirelessly to provide you ownership of your online presence while preventing harmful personal data from hurting you in Google search results.

With the right plan for managing your online reputation, you can defend your online privacy from sites like LexisNexis while controlling your online reputation and public perceptions.

Call an InternetReputation data removal specialist today at 941-259-4554 or contact us online to learn more.